The US Energy information Administration (EIA) released its updated Short Term Energy Outlook (STEO) on May 8, 2012. The overview calls for falling crude oil prices, falling gasoline prices, falling electric demand but higher natural gas prices as the prospect of exports reduces fears of excess inventory.

The STEO is always a volatile cocktail of near term market fluxuations and this update is no different. The question is whether this short term forecast is good news or bad news about the economic future. In the case of global oil the answer is mixed. Falling crude prices reflect the weakening of demand in the EU, in the US and in China. This is not good news for our economies. But weaker demand is allowing inventories to grow modestly and that reduces upward pressure on oil prices as spare productive capacity grows.

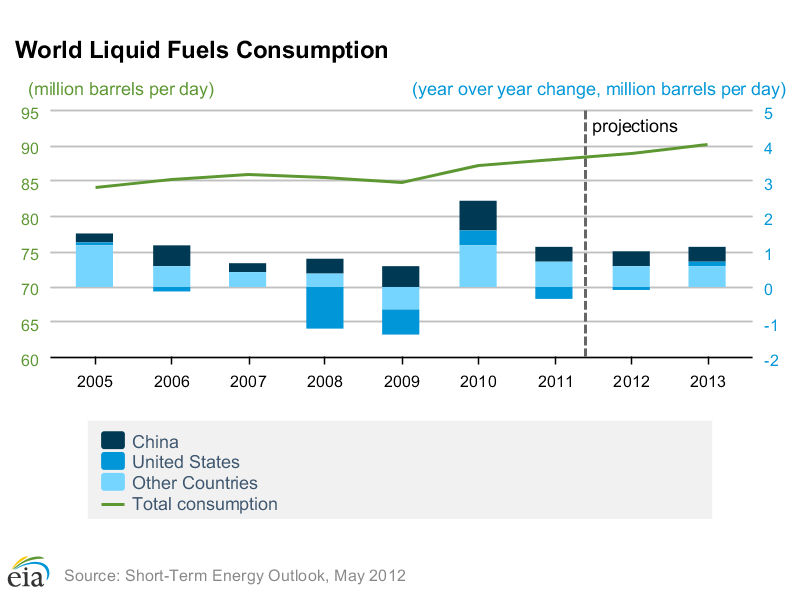

The focus of this good news versus bad news story is global oil and liquid fuel consumption and what it means for our economic outlook:

Global Oil Consumption Up Modestly. US EIA expects world oil and liquid fuels consumption to grow modestly over the next 24 months almost entirely from faster economic growth in China and other non-OECD emerging markets. Compared to 0.8 million bbl/d growth in 2011, EIA expects consumption growth of 1.0 million bbl/d in 2012 and 1.2 million bbl/d in 2013. Meanwhile, OECD liquid fuels consumption is forecast to fall by 0.4 million bbl/d in 2012 and 2013 forecast OECD consumption will be flat.

Global Oil Supply Keeps Pace. EIA expects OPEC will produce about 30 million bbl/d of crude oil over the next two years to meet projected demand and to replace oil from supply disruptions. Projected OPEC crude oil production in the STEO increases by about 1.0 million bbl/d in 2012 and then falls by 0.3 million bbl/d in 2013 as non-OPEC supply growth increases (North America) and stocks remain flat. OPEC non- are not covered by OPEC’s production quotas, are forecast to grow by 0.2 million bbl/d in 2012, and by 0.1 million bbl/d in 2013.

Despite Falling Iranian Production. EIA expects Iran’s crude production to fall by about 500 thousand bbl/d by the end of 2012 and by an additional 200 thousand bbl/d in 2013, from its 3.55 million bbl/d at the end of 2011. Iran’s output decline began in the last quarter of 2011 and will accelerate due to lack of investment needed to offset natural production declines.

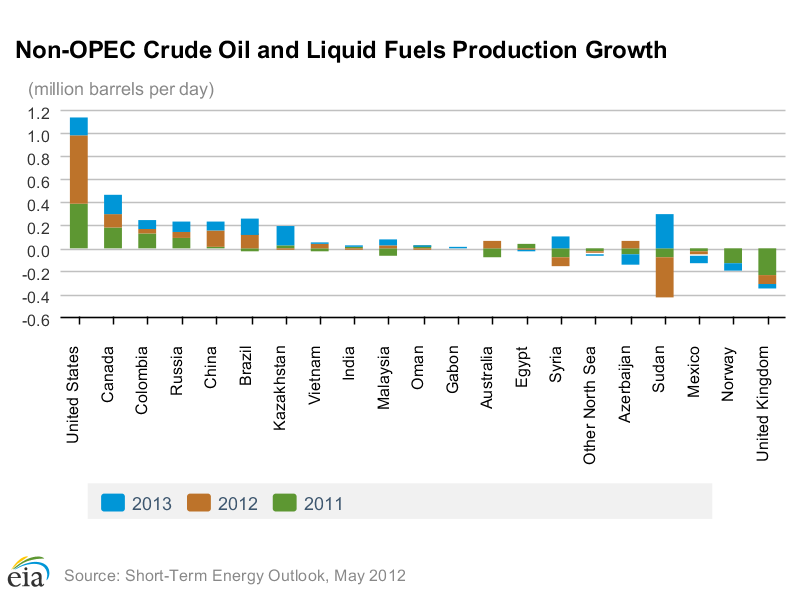

As North American Shale and Oil Sands Production Grows. EIA expects non-OPEC crude oil and liquid fuels production to grow 0.7 million bbl/d in 2012 and 1.1 million bbl/d in 2013. The good news is the biggest growth in non-OPEC production is coming from North America, where production increases by 680 thousand bbl/d and 260 thousand bbl/d in 2012 and 2013, respectively from U.S. onshore shale and tight oil formations and Canadian oil sands.

While Others Work to Catch Up. Brazilian grows an average of 130 thousand bbl/d over the next two years from offshore, pre-salt oil fields. EIA also expects that Kazakhstan will bring its Kashagan field online increasing its total production by 160 thousand bbl/d in 2013. EIA also expects oil production will grow in China and Colombia over the next two years, but production declines in Mexico and the North Sea.

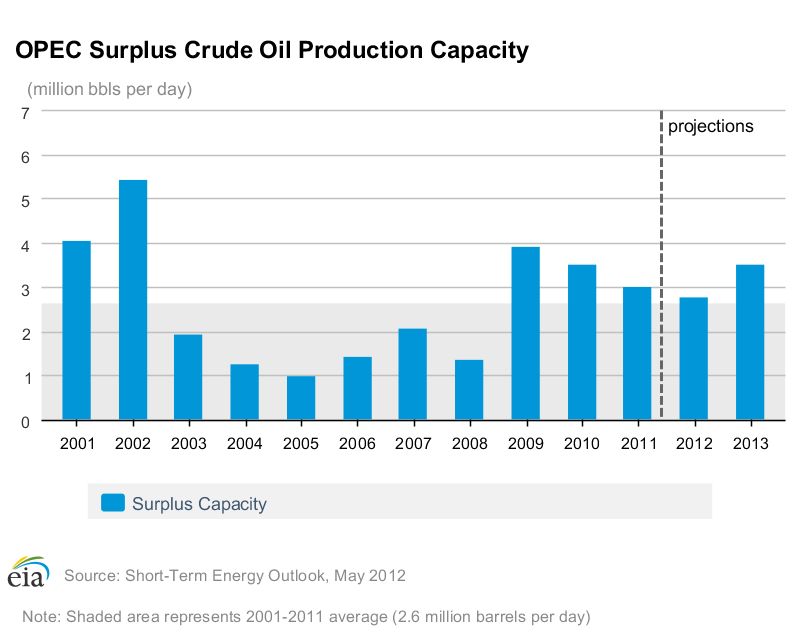

Spare Capacity Sets the Price of Oil. EIA estimates OPEC surplus production capacity will average 2.8 million bbl/d in 2012 and 3.5 million bbl/d in 2013. But the question remains whether OPEC can fully make up lost Iranian oil. Spare productive capacity is the largest factor in setting the global price of crude oil. EIA estimates that OECD commercial oil inventories ended 2011 at 2.59 billion barrels, equivalent to 56.1 days of forward-cover increasing to 2.64 billion barrels or 57.3 days of forward-cover by the end of 2012 because of the decline in OECD consumption. The recent reduction in crude oil prices is caused by perceived weaker demand even while spare capacity is sufficient and firming and North American production is growing.

Growing Domestic North American Energy Production is a Winning Formula. I repeat my belief that the continued growth of North American oil production is among the most important factors in increasing global spare productive capacity and thus moderating crude oil prices. Think about it—the 0.7 thousand barrels of oil per day growth in 2012 North American oil product ion represents 25% of the OPEC spare capacity estimate and in 2013 the projected 1.1 million b/d is 31% of projected OPEC spare capacity.

Growing North America’s domestic energy production creates real jobs, right now, here at home. It produces tax revenue and economic growth when we need it most. Lower crude oil prices moderate inflation and boost disposable income. The good news is we are experiencing this domestic energy growth almost entirely on private lands from shale, tight sands and oil sands. But this is a fraction of the domestic production potential that could take place if the US Government would make domestic energy production on public lands, offshore and in the Gulf of Mexico and Alaska a priority.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Short Term Energy Outlook: Good Or Bad News?

Published 05/15/2012, 02:21 AM

Updated 07/09/2023, 06:31 AM

Short Term Energy Outlook: Good Or Bad News?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Love the charts. Very informative. Thank you for the piece.

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.