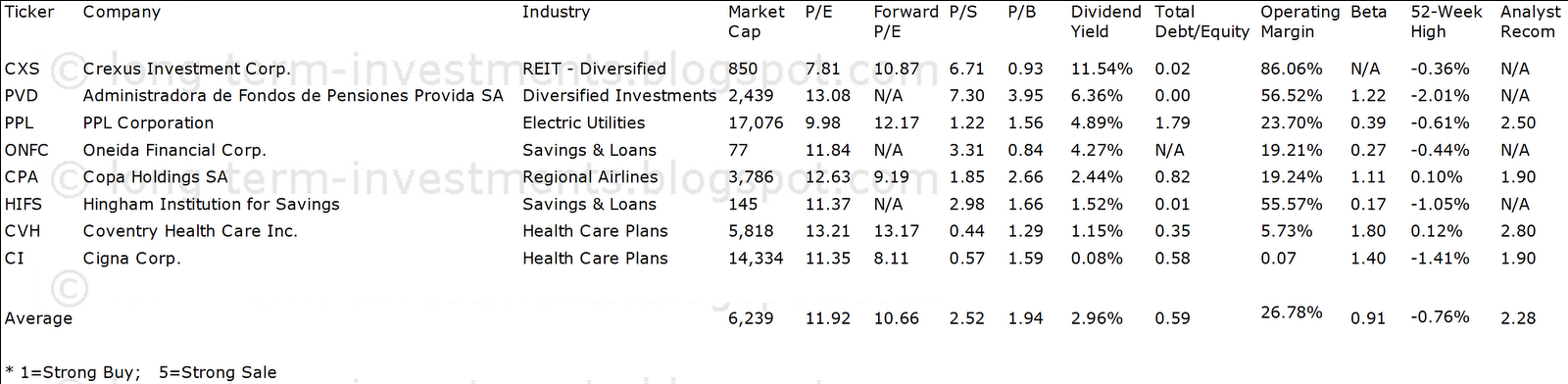

Here is a current sheet of dividend stocks (positive yield) that have marked a new 52-Week High within recent days. Despite the turmoil within the markets, there are 65 companies at one-year highs and 33 of them pay dividends. I screened the best performing stocks and analyzed all with a P/E ratio below 15 and a positive yield. Eight companies fulfilled these criteria of which three have a buy or better recommendation.

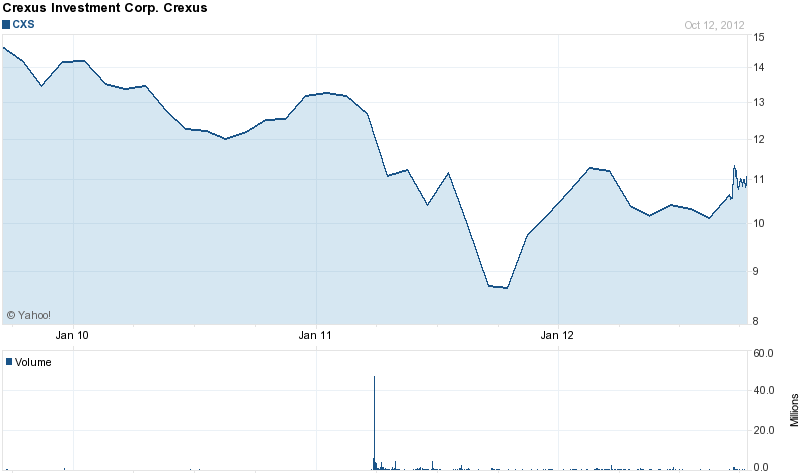

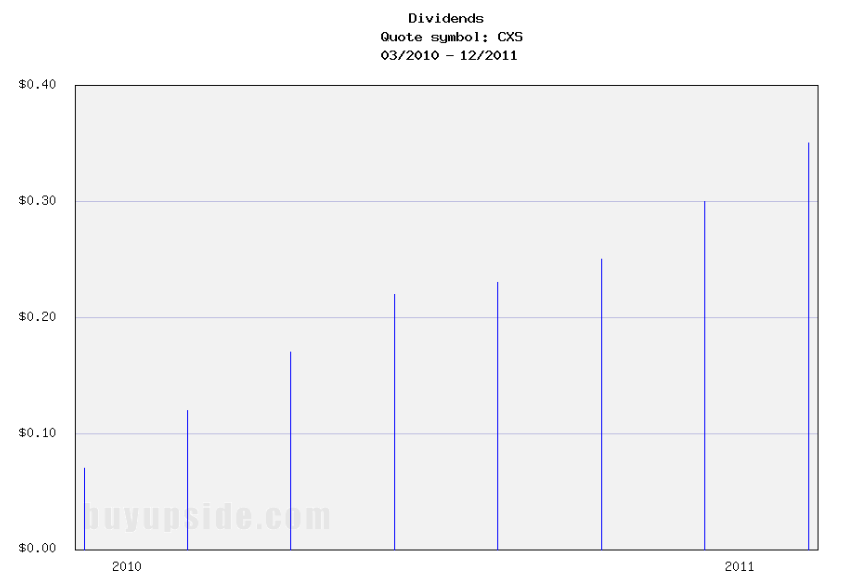

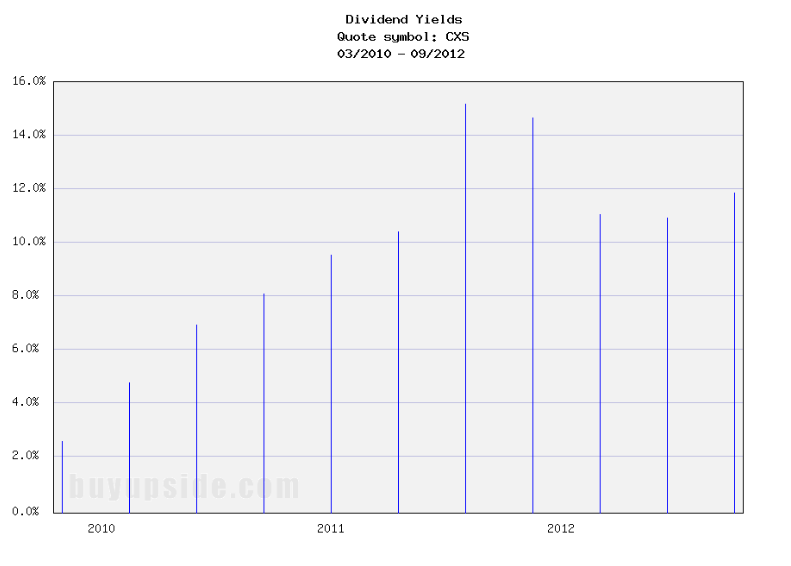

Crexus Investment (NYSE:CXS) has a market capitalization of $849.83 million. The company generates revenue of $105.67 million and has a net income of $108.40 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $89.97 million. The EBITDA margin is 85.14 percent (operating margin 102.58 percent and net profit margin 102.58 percent).

Financial Analysis: The total debt represents 3.16 percent of the company’s assets and the total debt in relation to the equity amounts to 3.38 percent. Due to the financial situation, a return on equity of 18.14 percent was realized. Twelve trailing months earnings per share reached a value of $1.42. Last fiscal year, the company paid $1.13 in form of dividends to shareholders. The stock is 0.36 percent below 52-Week High.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 7.80, P/S ratio 8.02 and P/B ratio 0.91. Dividend Yield: 11.57 percent. The beta ratio is not calculable.

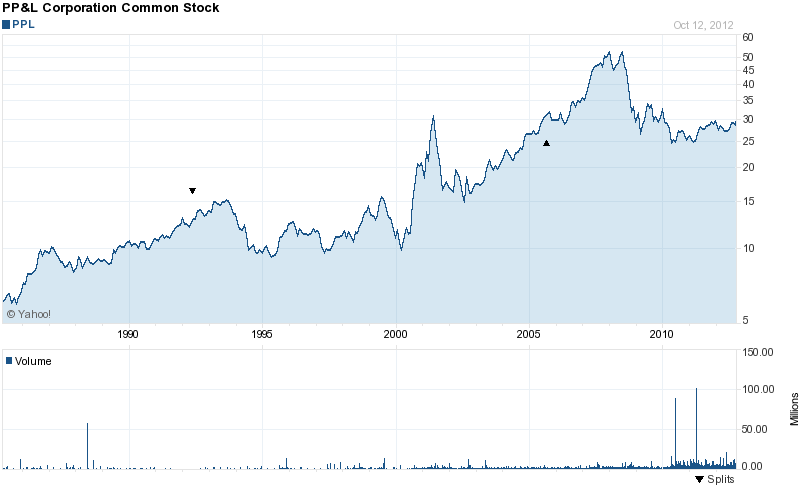

PPL Corporation (NYSE:PPL) has a market capitalization of $17.10 billion. The company employs 17,722 people, generates revenue of $12,737.00 million and has a net income of $1,510.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $4,309.00 million. The EBITDA margin is 33.83 percent (operating margin 24.30 percent and net profit margin 11.86 percent).

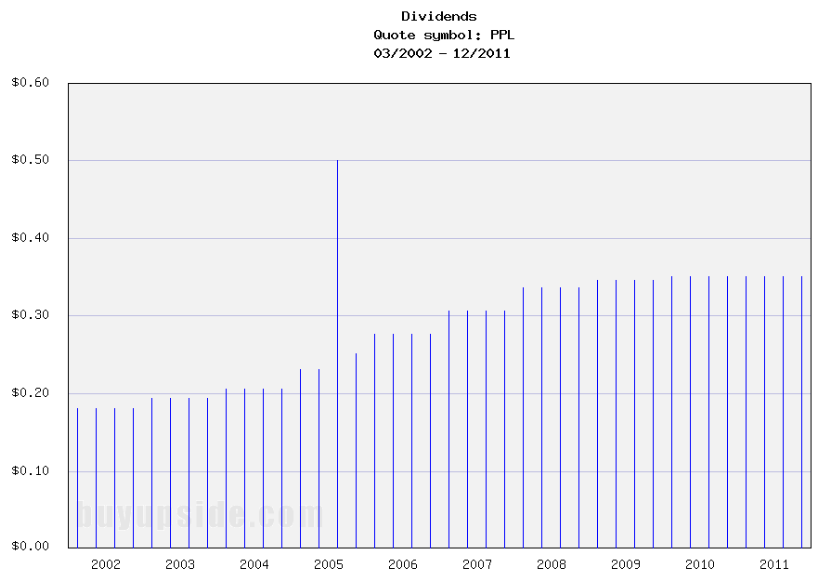

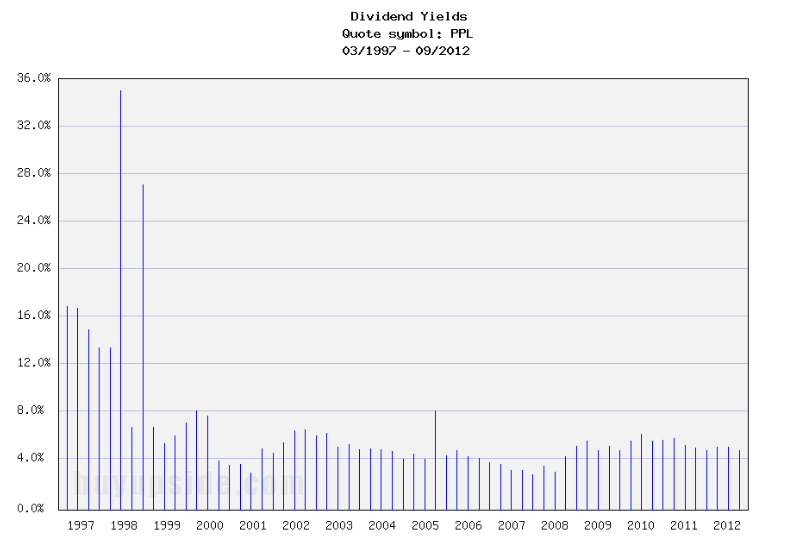

Financial Analysis: The total debt represents 43.54 percent of the company’s assets and the total debt in relation to the equity amounts to 171.51 percent. Due to the financial situation, a return on equity of 15.62 percent was realized. Twelve trailing months earnings per share reached a value of $2.95. Last fiscal year, the company paid $1.40 in form of dividends to shareholders. The stock is 0.61 percent below 52-Week High.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 9.98, P/S ratio 1.34 and P/B ratio 1.57. Dividend Yield: 4.89 percent. The beta ratio is 0.39.

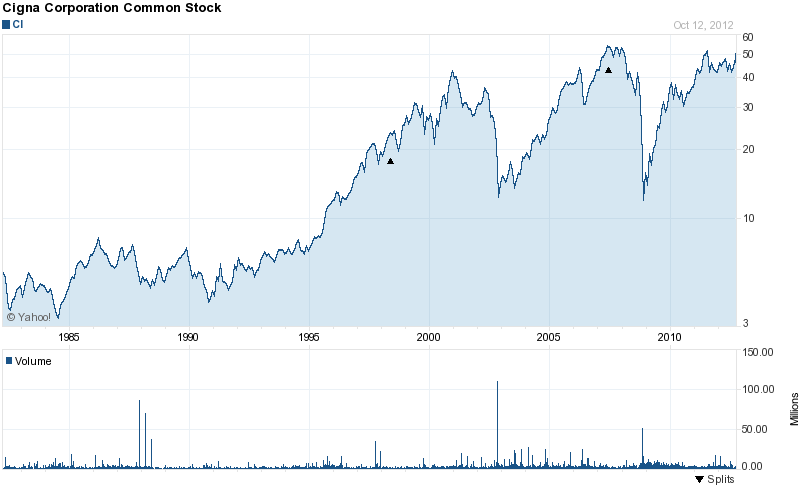

CIGNA Corporation (NYSE:CI) has a market capitalization of $14.33 billion. The company employs 31,400 people, generates revenue of $21,998.00 million and has a net income of $1,328.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $9,853.00 million. The EBITDA margin is 44.79 percent (operating margin 8.95 percent and net profit margin 6.04 percent).

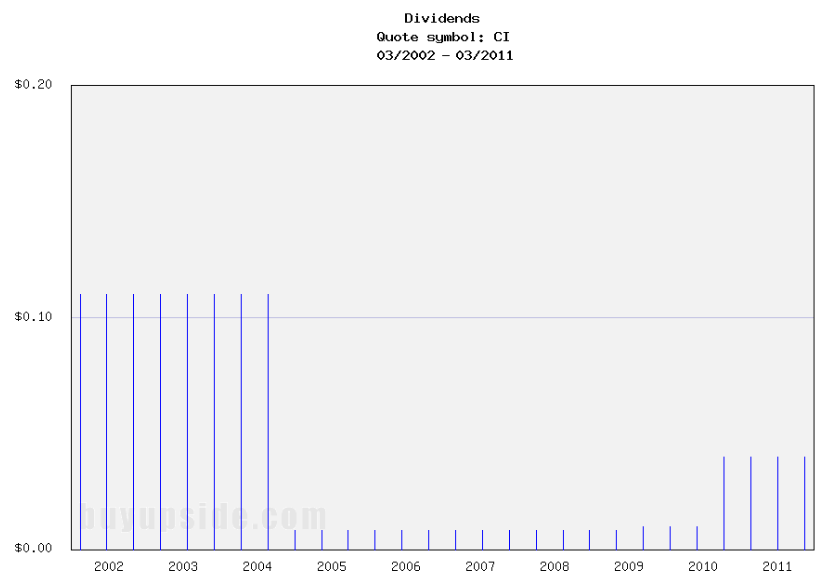

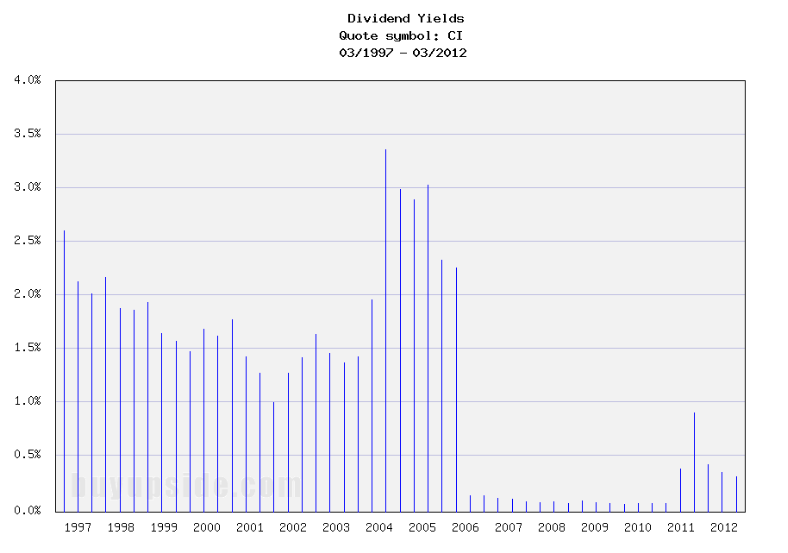

Financial Analysis: The total debt represents 9.98 percent of the company’s assets and the total debt in relation to the equity amounts to 61.05 percent. Due to the financial situation, a return on equity of 17.71 percent was realized. Twelve trailing months earnings per share reached a value of $4.38. Last fiscal year, the company paid $0.04 in form of dividends to shareholders. The stock is 1.41 percent below 52-Week High.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 11.35, P/S ratio 0.66 and P/B ratio 1.72. Dividend Yield: 0.08 percent. The beta ratio is 1.39.

Take a look at the full table of high yield stocks at new 52-Week Highs. The average price to earnings ratio amounts to 11.92 while the average forward price to earnings ratio amounts to 10.66. The average dividend yield is 2.96 percent. Price to book ratio is 1.94 and price to sales ratio 2.52. The stocks are 0.76 percent below new 52-Week Highs.

Related stock ticker symbols:

CXS, PVD, PPL, ONFC, CPA, HIFS, CVH, CI

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI