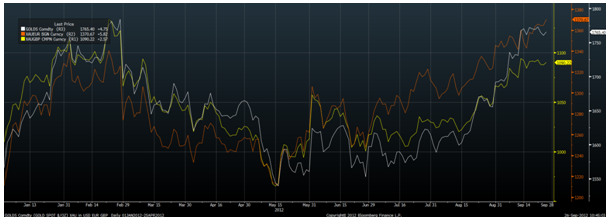

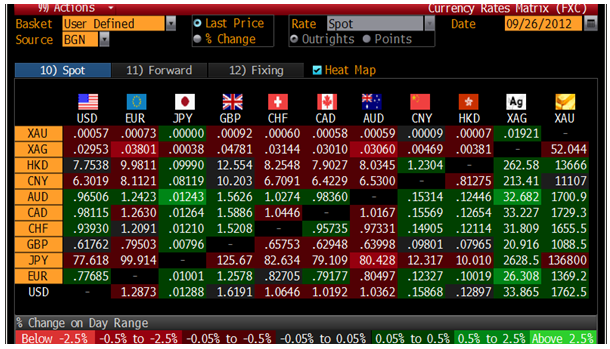

Today’s AM fix was USD 1,763.75, EUR 1,369.80, and GBP 1,089.07 per ounce.

Yesterday’s AM fix was USD 1,766.75, EUR 1,369.36 and GBP 1,088.37 per ounce.

Gold fell $3.10 or 0.18% in New York yesterday and closed at $1,761.40. Silver rose to $34.47 in early New York trade then fell off and finished with a loss of 0.71%.

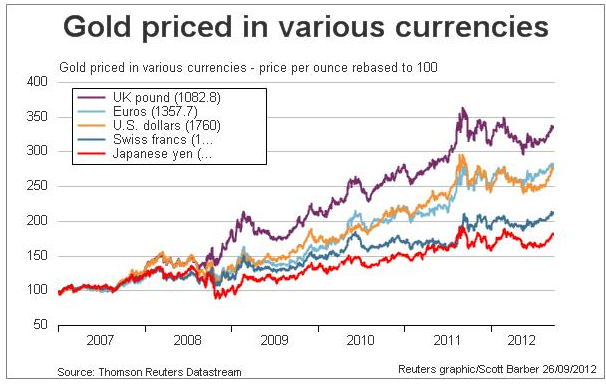

Gold continues to eke out gradual gains in all currencies. It looks set for the best quarterly gain in more than two years, as central banks and investors diversify into gold to hedge against the prospect of weaker currencies and slowing growth.

Euro gold hovering near record highs at €1,375/oz shows the eurozone crisis is far from over and is indeed set to deepen in coming months. The overnight joint declaration of Germany, the Netherlands and Finland appears to unravel much of what was agreed at the last European summit in June, when EU leaders attempted to pave the way for the direct recapitalisation of troubled banks, is gold bullish.

The IMF has warned that the financial system remains "vulnerable" and is a work in progress. In Spain, protestors fought with police in Madrid as the government embarks on a new phase of austerity measures for the 2013 budget this Thursday.

The SPDR Gold Trust ETF said its holdings had risen to a record high of 1,331.331 tonnes by September 25.

Unrest in South Africa continues and the fourth largest producer in the world, Goldfields, said that workers reneged on a deal to end a two week strike at its KDC West operation and miners at its Beatrix mine had also downed tools. AngloGold Ashanti Ltd., the world’s third-largest gold producer, halted production at all of its South African mines as labor unrest that left at least 46 dead in the past two months continues to spread.

Julius Malema, expelled as youth leader from South Africa’s ruling African National Congress, was granted bail on a charge of money laundering.

Germany's Federal Statistical Office is scheduled to release flash inflation data at 8.00 am ET.

The IMF reported that various countries continued diversifying into gold in July, some significantly.

South Korean gold reserves rose a sharp 16 tonnes for a 30% increase in total gold reserves. Paraguay became the latest central bank to begin diversifying into gold. Their gold reserves rose sharply - from a few thousand ounces to over 8 tonnes.

Desperate North Korea has exported more than 2 tons to gold hungry China over the past year to earn US $100 million. Even in tough times during the Kim Il-sung and Kim Jong-il regimes, North Korea refused to let go of its precious gold reserves.

Chosun media reports that “a mysterious agency known as Room 39, which manages Kim Jong-un's money, and the People's Armed Forces are spearheading exports of gold, said an informed source in China. "They are selling not only gold that was produced since December last year, when Kim Jong-un came to power, but also gold from the country's reserves and bought from its people."

This is a sign of the desperation of the North Korean regime and also signals China’s intent to vastly increase the People’s Bank of China’s gold reserves. Data on the International Monetary Fund’s website shows Kazakhstan’s assets rose 1.4 tons to 104.4 tons last month, Turkey’s gold reserves gained 6.6 tons to 295.5 tons, Ukraine’s rose 1.9 tons to 34.8 tons.

While the Czech Republic’s bullion assets fell 0.4 ton to 11.8 tons, data shows. Nations bought 254.2 tons in the first half of 2012 and may add close to 500 tons for the year as a whole, the London-based World Gold Council said earlier this month.

The trend among central banks to diversify their foreign exchange reserve holdings with gold continues. This trend is very sustainable considering the still tiny allocations creditor nation’s banks, with massive foreign exchange reserves, have to gold.

Paraguay is a new central bank gold buyer – expect many more central banks to begin increasing their gold reserves in the coming months.

NEWSWIRE

(Bloomberg) -- Barclays Says Gold Will Outperform Other Precious Metals From QE

Gold will outperform other precious metals as quantitative easing takes effect, Barclays Plc said. Aluminum is the weakest industrial metal based on fundamentals, and China’s metals stockpiles are modest and falling, Barclays said in a report distributed to reporters today in London. Prospects are high for a very large price spike in oil due to low spare capacity and potential for problems in the Middle East, it said.

‘"QE is not a rising tide that will take all boats,’’ Paul Horsnell, head of commodity research at Barclays, told reporters today. “It is good for gold. Gold will move from one of the weakest commodities this year to one of the best performers over the next few quarters.”

(Bloomberg) -- Cash Gold in Shanghai Poised for Best Quarter in Five Years

Cash gold of 99.99 percent purity on the Shanghai Gold Exchange was little changed at 358.35 yuan a gram at 9:01 a.m. Singapore time, up 12 percent this quarter and set for the biggest such advance since the three months to September 2007. Volumes for the benchmark contract on the country’s largest cash bullion market were 3,267 kilograms yesterday, up from 2,915 kilograms on September 21.

Gold for December delivery fell as much as 0.3 percent to 359.97 yuan a gram ($1,775.18 an ounce) on the Shanghai Futures Exchange, and was last at 360.33 yuan. The metal has risen 11 percent since the end of June, poised for its best quarterly showing since December 2009. December-delivery silver declined for a third day, falling as much as 0.6 percent to 7,118 yuan per kilogram, before trading at 7,135 yuan.

(Bloomberg) -- Explosive’ Gold ETP Demand Driving Price Rally, Saxo Bank Says

An “explosive” gain in demand for gold in exchange-traded products is helping to drive the metal’s price rally, Ole Hansen, the head of commodity strategy at Saxo Bank A/S in Copenhagen, said on the Bloomberg LiveINSIGHTS precious metals web conference today. “Hedge funds have only just begun to get involved, having waited for momentum to return, leaving them plenty of room to increase positions.”

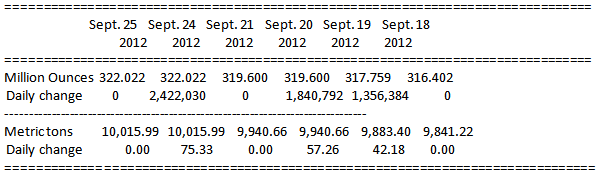

(Bloomberg) -- IShares Silver Trust Holdings Unchanged at 10,016 Metric Tons

Silver holdings in the IShares Silver Trust, the biggest exchange-traded fund backed by silver, were unchanged at 10,015.99 metric tons as of Sept. 25, according to figures on the company’s website.

NOTE: Ounces are troy ounces.

(Bloomberg) -- Gold Prices May Climb to $2,000 Next Year, Commerzbank Says

Gold may rise to $2,000 an ounce next year, said Eugen Weinberg, the head of commodities research at Commerzbank AG in Frankfurt.

“I am bullish on gold as there are not many alternative investments,” Wienberg said on the Bloomberg LiveINSIGHTS precious metals web conference today. “There are too many economic risks today, and the risks are not yet priced in, so I see demand for gold rising.”

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI