A. O. Smith Corporation (NYSE:AOS) reported disappointing fourth-quarter 2019 results wherein both earnings and revenues missed estimates.

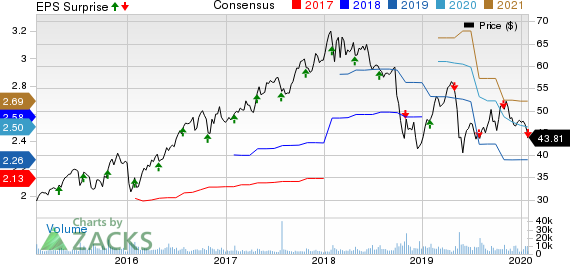

The company’s adjusted earnings were 56 cents per share, missing the Zacks Consensus Estimate of 60 cents. Also, the bottom line declined from the year-ago figure of 74 cents.

The company reported 2019 adjusted earnings of $2.22, a decrease of about 14% from the prior year.

Inside the Headlines

The company’s fourth-quarter net sales decreased 7.6% year over year to $750.9 million. The decline was primarily attributable to lower sales in China. Also, the figure missed the Zacks Consensus Estimate of $777 million.

In 2019, the company reported net sales of $2,992.7 million, down 6.1% from the year-ago number.

A.O. Smith’s sales in North America (comprising U.S. and Canadian water heaters and boilers) inched up 0.2% year over year to $523.1 million. The segment’s results benefited from higher sales volumes of water treatment products and contribution from its Water-Right acquisition, partially offset by lower sales volume of boiler products.

Segmental operating earnings were relatively flat year over year at $128.4 million. Benefits of lower steel costs were offset by lower boiler volumes.

Quarterly sales in Rest of World (including China, India and Europe) fell 21.3% year over year to $234.3 million. The decline was primarily attributable to soft consumer demand and above normal channel inventory levels, as well as a higher mix of mid-price products.

Operating earnings at the segment significantly declined to $1.5 million from $39.5 million in the year-ago quarter. Lower sales in China proved detrimental to the segment’s income.

Share Repurchases

In 2019, A.O. Smith repurchased around 6.1 million shares for $287.7 million. At the end of the quarter, the company had approximately 3 million shares remaining under the existing discretionary repurchase authority.

Liquidity & Cash Flow

On Dec 31, 2019, A.O. Smith’s cash and cash equivalents totaled $374 million compared with $259.7 million as of Dec 31, 2018.

At the end of the reported quarter, long-term debt was $277.2 million compared with $221.4 million as of Dec 31, 2018.

Guidance

Concurrent with fourth-quarter results, the company issued guidance for 2020. It expects adjusted earnings to lie in the range of $2.40-2.50 per share. The mid-point reflects impressive year-over-year growth of 10%. In addition, the company expects to register revenue growth in the band of 4.5-5.5% for 2020.

Zacks Rank & Key Picks

A.O. Smith currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks are Cintas Corporation (NASDAQ:CTAS) , Emerson Electric Co. (NYSE:EMR) and Crane Company (NYSE:CR) . All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cintas delivered positive earnings surprise of 8.50%, on average, in the trailing four quarters.

Emerson delivered positive earnings surprise of 3.03%, on average, in the trailing four quarters.

Crane’s positive earnings surprise in the last reported quarter was 0.64%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Crane Company (CR): Free Stock Analysis Report

Cintas Corporation (CTAS): Free Stock Analysis Report

Emerson Electric Co. (EMR): Free Stock Analysis Report

A. O. Smith Corporation (AOS): Free Stock Analysis Report

Original post