By Herbert Lash and Stephen Culp

NEW YORK (Reuters) -Wall Street pared earlier gains on Tuesday after equity markets elsewhere rallied as investors parsed when and by how much the Federal Reserve cuts interest rates this year, while a resurgent dollar helped weaken the yen further.

MSCI's gauge of global stock performance closed up 0.30% and European shares ended at record closing peaks.

Benchmark Treasury yields softened, but the dollar rose on the prospect of stronger U.S. growth and potentially higher rates than other developed economies.

"It's a quiet day, the major averages are flat, and there's some profit taking," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York. "The focus remains on the Fed, but the Fed is pretty clear that there's little that's happening any time soon."

A weaker-than-expected U.S. jobs report on Friday following the prior week's GDP reading, which showed the slowest growth in nearly two years, provoked a dovish pivot among investors regarding how soon and by how much the Fed cuts rates.

Traders are now pricing in 44 basis points of Fed rate cuts by the end of 2024, with a first cut possibly in September, according to LSEG's rate probability app. Traders had recently priced in just one cut due to sticky inflation data.

But potentially stalled progress on inflation means monetary policy may be less restrictive than officials believe, Minneapolis Fed President Neel Kashkari said in an essay that raises the possibility that prices are "settling" at a level above the Fed's 2% target.

"It's not that we don't think that inflation is going to come down. We just don't think that in view of having had three top-side prints on inflation, that we're going to get comfort with inflation that quickly," said Thierry Wizman, global FX and interest rates strategist at Macquarie in New York.

"It's going to take more than one print, maybe even more than two prints of low inflation before the Fed is comfortable, and that just means that there's not going to be enough time potentially this year to squeeze in two rate cuts."

On Wall Street, the Dow Jones Industrial Average rose 0.08%, the S&P 500 gained 0.13% and the Nasdaq Composite dropped 0.1%.

Upbeat earnings from the financial sector as well as optimism the European Central Bank cuts rates as early as next month lifted stocks in Europe. The pan-regional STOXX 600 index closed up 1.14%. Germany's DAX surged 1.4%.

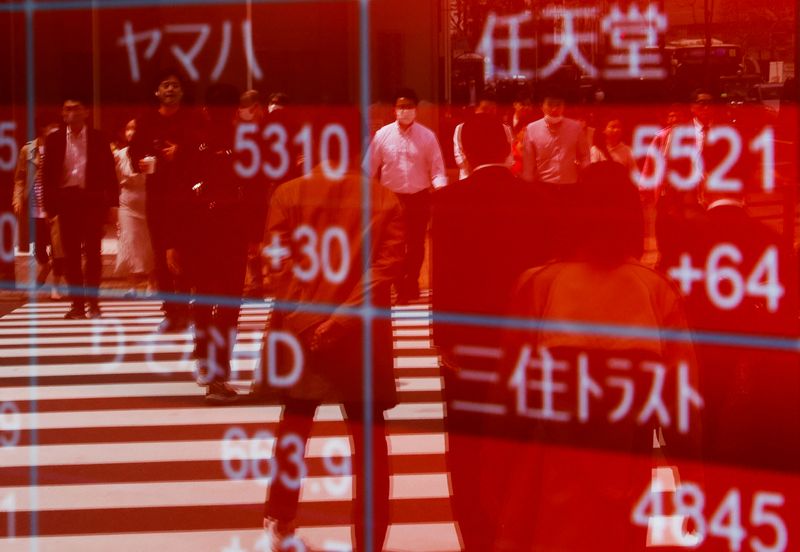

Emerging market stocks rose 0.14%. MSCI's broadest index of Asia-Pacific shares outside Japan closed 0.26% higher, while Japan's Nikkei rose 1.57%.

The dollar reversed an early drop and was last higher against a basket of world currencies, strengthening against the yen even after new warnings from Japanese officials about their willingness to prop up their currency.

The dollar index rose 0.3%, with the euro down 0.14% to $1.0753.

The Japanese yen weakened 0.49% versus the greenback at 154.68 per dollar, while sterling was last trading at $1.2508, down 0.42% on the day.

Longer-dated Treasury yields slipped as traders focused on absorbing $125 billion in new supply this week, while a parade of Fed officials is lined up to speak on prospects for a 2024 policy pivot.

The yield on the benchmark 10-year note fell 3 basis points to 4.459%, while the two-year note's yield, which reflects interest rate expectations, rose 0.6 basis points to 4.828%.

Oil prices closed slightly lower on signs of easing supply concerns. U.S. crude fell 0.13% to settle at $78.38 per barrel, while Brent settled down at $83.16 per barrel.

Gold slipped, giving up the previous session's gains, as traders remained focused on the prospect for Fed rate cuts.

U.S. gold futures settled 0.3% lower at $2,324.20 per ounce.